Being strategic and proactive is very important for any business, especially in our fast-changing world. The competitive environment requires innovative actions and forward-thinking. And utilizing relevant data is the best way to make well-informed decisions, develop unique strategies, and open better opportunities for business growth.

Predictive data allows businesses to see possible risks. With different types of trend analysis, you can identify patterns to make forecasts about a company's future performance.

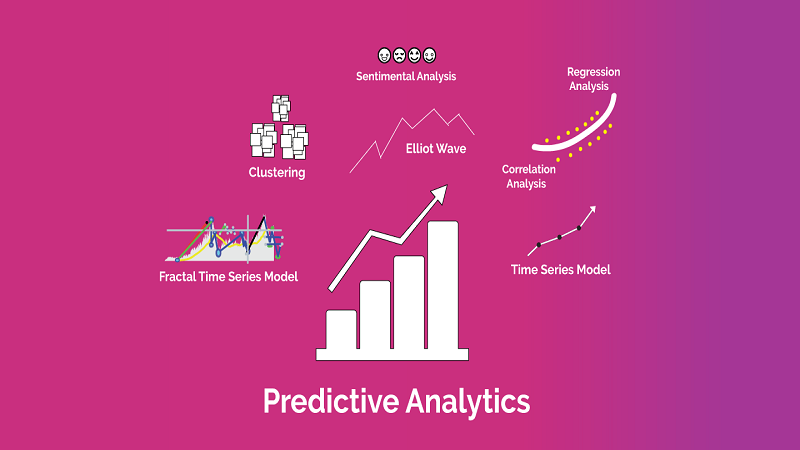

What is predictive analytics

This type of advanced analytics utilizes modern technologies, such as artificial intelligence, machine learning, data mining, etc to predict future outcomes, behaviors, and trends.

The application of various statistical analysis techniques, queries, and algorithms to data sets is used to create predictive models. They place a numerical value on the chance of a certain event happening.

With predictive analytics techniques, companies can interpret historical data and discover various patterns, which show certain possible risks and opportunities.

Historical data, which is used as the main source for predictive data, can help data scientists to identify patterns and trends within data through applying various techniques and using different models.

Why is predictive analytics important

Predictive analytics offers great value to companies of any size. It may play an important role in decision-making. Moreover, many organizations use predictive analytics to solve difficult business problems.

Businesses succeed or fail based on how well they conduct and implement predictive analysis to their operations. If companies don’t take into consideration the importance of data analytics, there are higher chances of them failing and losing investments.

According to Allied Market Research, the market of global predictive analytics is projected to reach US$35.45 billion by 2027. And its compound annual growth rate (CAGR) is calculated to be 21.9%. Massive amounts of data are generated daily, technologies are developing, making computers more powerful in the data processing.

Moreover, there are many types of software that can be used for predictive analytics and it’s becoming much easier to use it. That’s why the popularity of predictive data is continuously growing.

Predictive analytics use cases

There are several important business aspects, where predictive analytics can be critical for creating the right solution, including:

- Fraud detection. Byusing multiple analytics methods, companies can better detect suspicious behaviors. Cybersecurity is considered to be a great concern of many companies. Predictive analytics can help to identify abnormalities on a network that can be a sign of fraud. It’s important to take proactive actions to reduce any chances of threats.

- Marketing campaigns optimization.With predictive analytics companies are able to determine possible customer responses to their marketing efforts. It can also provide insights into cross-sell opportunities.

- Acceleration of business operations.This type of analytics helps businesses to manage their resources more efficiently. Also, many companies can forecast inventory with predictive models.

- Risk reduction. There are certain examples in finance, where predictive analytics is used to forecast credibility. Those include credit scores and insurance claims, as they help to identify possible risks and in the case of credit scores – a person's creditworthiness.

Also, in Gartner’s Hype Cycle for Analytics and Business Intelligence 2020, where current key technology trends were analyzed and classified, prescriptive analytics is sitting at the peak.

Benefits of predictive analytics

There are many valuable benefits of using predictive analytics. It can help businesses to make predictions about outcomes that can be expected when there are no answers available.

Predictive analytics is extremely valuable in banking and financial services, as it helps to assess risk as well as maximize customer relationships. Business leaders, investors, and professionals in the financial sphere use predictive models mostly to help reduce risk.

An example of using these models would be when creating an investment portfolio. Investors can use various predictive models to identify which investments have minimal risk.

Also, among other benefits, cost efficiency stands out. Businesses are able to see whether the product they want to launch is going to be successful or not. Also, based on predictive models, companies can identify how many resources are needed for manufacturing before the start of the whole process.

The most common models used in predictive analytics

There are many different predictive models. They are based on the type of outcome, which they are set to achieve. Each algorithm in the model is quite complex, however, there are several most popular predictive analytics algorithms, which are commonly used by many companies.

The most common predictive analytics models include:

- Linear Regression

- Logistic Regression

- Linear Discriminant Analysis

- Decision Trees

- Naive Bayes

- K-Nearest Neighbors

- Support Vector Machines

- Random Forest

- Boosting

The common techniques used in predictive analytics

To determine what type of predictive analytics techniques will suit your business best, you should first identify what you want to achieve with predictive analytics. You need to have clearly defined objectives, as it will help you identify the right model and get the most out of your analysis.

The process of predictive analytics consists of defining a particular goal, then collecting huge amounts of data. After that the predictive models can be built using sophisticated algorithms and techniques. The commonly used techniques include:

Decision Trees

This technique is for those who want to better understand what is behind someone's decisions and what influences them. The decision trees technique places data into several sections based on variables, such as market capitalization or price. This predictive model looks like a tree that has branches and leaves. Branches represent the available choice, while leaves serve as a certain decision.

This type of predictive model is one of the easiest, as it’s very simple. While it’s easy to understand, it’s also useful for those who have to make an important decision quickly.

Regression

Regression is used mostly in statistical analysis. Companies prefer regression when they want to determine certain patterns in large data sets. Also, this type of predictive model can be used when there's a linear relationship between the inputs.

The regression technique works with a formula that represents the relationship between all inputs in a data set.

Neural Networks

Neural networks kind of imitate the way the human brain works. This predictive model uses artificial intelligence to deal with complex data relationships. It’s also known for its pattern recognition. Businesses can use this model if they struggle with some hurdles that they need to overcome.

For example, having too much data, no formula to find the relationship between inputs and outputs, or instead of creating explanations, companies want to make some predictions.

Conclusion

Predictive analytics serves as an important analytical technique. Many organizations, both large and small, use predictive analysis to determine certain risks, foresee future business trends and recognize when additional resources or actions are needed.

The main purpose of predictive analytics is to somewhat accurately identify what may happen in the future. Predictive analytics is a key tool to fuel an analytical company’s journey where statistical analysis methods are used in combination with advanced technologies like machine learning and artificial intelligence.

Predictive analytics can transform the way a business performs and operates overall. It helps companies to get more competitive advantages and discover more opportunities to reduce risks, leading to financial damages.