If you have a fleet of vehicles that you use for your business, there are many factors to consider when insuring them, including the value of the vehicles, the types of accidents that might happen, and the drivers who will be operating them on your behalf.

While all of these factors can potentially impact your vehicle insurance rates, another factor to consider is the emergence of electric cars, which are gaining popularity among people who want an environmentally friendly option or even just those who want to save money on gas and reduce their carbon footprint. So, what is the impact of this new wave of vehicles on fleet insurance?

When Parts Are Damaged, They're More Likely to Be Replaced Than Repaired

The more damage done to a vehicle from any cause, the higher the insurance costs. This is especially true of electric cars; because these vehicles are still new and largely untested by time and use, parts for them are more expensive than for traditional vehicles.

Unfortunately, it's also much easier to damage an electric car irreparably than one that runs on a combustion engine. If something goes wrong with a newer model car that doesn't run on fossil fuels, it may be cheaper to buy a new part or even replace the entire vehicle rather than have problems fixed over time.

As parts get replaced instead of repaired, costs will continue to rise—and insurance rates will go up along with them.

They Tend to Be More Expensive Than Combustion Vehicles

If you're looking to purchase a vehicle for your fleet, electric vehicles (EVs) may be on your list of options. However, EVs tend to be more expensive than combustion vehicles. It makes sense that more features and added tech will cost more.

It's also true that EVs are less likely to incur damage from crashes or rollovers due to their unique design elements. However, it's not all good news with EVs—they tend to have fewer standard safety features than other models and may be used in scenarios that increase their risk of being damaged in an accident.

Given these realities, fleet vehicle insurance premiums for EVs tend to be higher than those for traditional combustion vehicles.

They Are Cheaper to Maintain

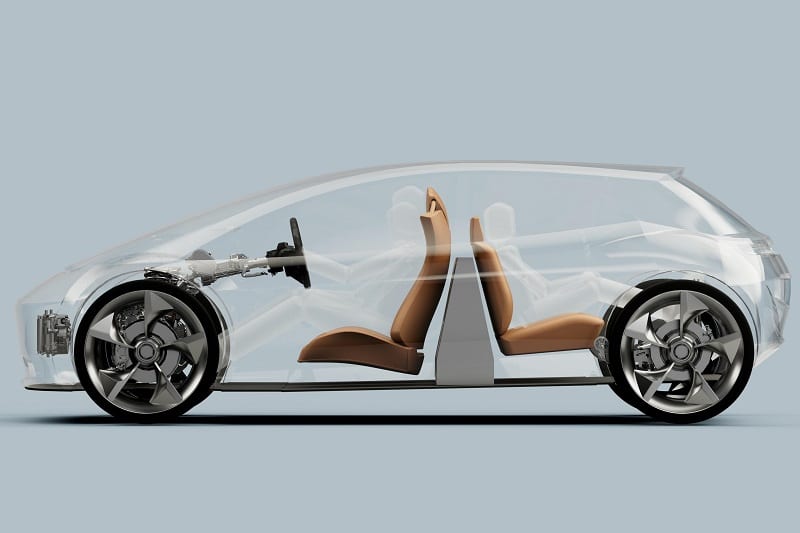

The main reason is simple; electric cars aren't as complex as combustion vehicles. They require fewer moving parts, and those parts are not subjected to nearly as much wear and tear or punishment from high speeds, which means that their breakdowns are less frequent and less severe.

You can get away with a smaller fleet vehicle insurance policy, leaving more money for fuel, repairs, etc. If your fleet consists of only electric vehicles, you may be able to cut your annual premiums in half!

This is especially true for fleet vehicle insurance policies, as insurers usually consider them less risky. With autonomous driving being added to EVs, more and more car manufacturers are guaranteeing safety to insurance providers and fleet owners. This means you'll have fewer accidents on your record and less money paid out in damages to other drivers.