Day trading is a rather risky investment and money-making strategy. It takes a lot of patience, knowledge, and practice to make money on this, and in this article, we will give you some tips on day trading.

Back in the day, only huge banks, wealthy people, mutual fund managers, and brokerage companies had the resources to engage in stock trading. In 2022, regardless of their money or investment quantity, anybody or any corporation may invest in or trade stocks.

Online brokerage businesses also make trading simple by providing free money and account-opening services. To obtain the best start in the realm of profitable trading, read this day trading tutorial for beginners.

Day Trading: What Is It?

In day trading, positions are closed out after each day's trading, and the following trading day is used to open new positions. To profit from minute changes in the market, day traders often acquire and sell various assets on the same day.

Since intraday trading requires time, attention, devotion, and a certain attitude, it is unsuitable for those who work part-time. Day trading entails making quick selections and carrying out several deals for just a modest profit each time. It is often seen as the antithesis of most investing methods, which aim to profit from market swings over a longer time horizon.

Sometimes day trading is compared to getting installment loans online due to the fact that this is a rather risky approach, but if you manage your funds correctly and build a competent strategy, it can help you on the way to your goal.

7 Day Trading Tips

Choose Assets With a Lot of Liquidity

When you day trade, you only purchase and sell assets throughout the trading day. For this reason, you could think about trading solely in markets that you can join or depart quickly. To be able to sell them anytime you need to, you may also want to choose liquid marketplaces.

Learn to spot market patterns so you can take advantage of opportunities. Before trading an asset, it might also be a good idea to look at its trading volume and follow its median volumes. Low-volatility assets might result in your exit orders not being carried out. Delivery trades are intraday deals that don't go through throughout the trading day.

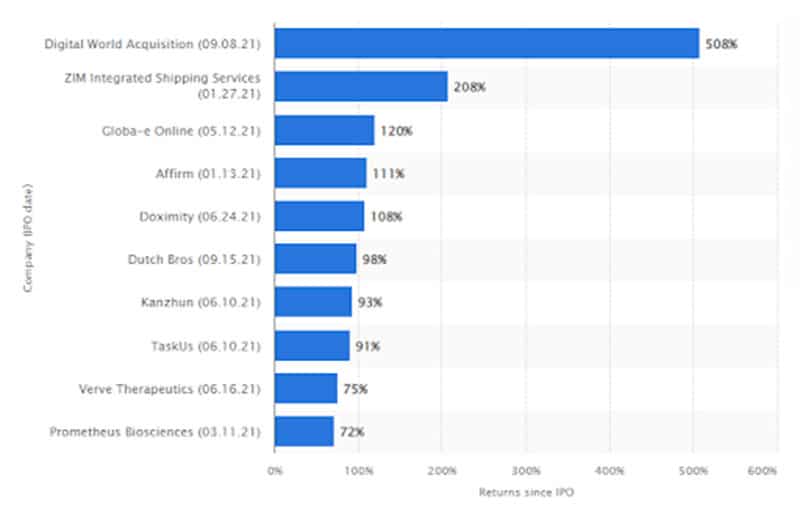

Look also for the most promising stocks. For example, the initial public offering (IPO) of Digital World Acquisition in the United States had the greatest performance between January and December 2021. Since the IPO in August 2021, their stock price has climbed by 508%.

Set Entry and Exit Goal Prices

The next step after choosing the stock you want to trade in is setting target prices for both entry and exit. A deal that is entered upon blindly with no objectives is certain to fail.

Set a price at which you would like to buy the stock and stick to it, even if doing so means missing the opportunity to do so. Set a target price at which you'd want to sell the stock similarly, even if doing so means you could lose out on any potential future profits.

Book Profit Upon Achieving the Goal

The secret to successful intraday trading is the enormous leverage and margins that traders enjoy. Margin and leverage can assist to magnify gains and losses. However, once that objective is attained, the challenge is to refrain from being avaricious. If the stock price has already surpassed your goal level, don't wait for it to rise much more.

Avoid making the mistake of believing that if you sell short, the price will keep going up or down. You must base your trading choices on techniques and facts rather than how you think a stock will perform. If there is convincing evidence that the price will almost certainly move in the desired direction, adjust the stop-loss.

Avoid Acting Contrary to the Market

Even seasoned experts with cutting-edge equipment are unable to forecast market moves. Even when all technical indicators point to a bull market, a drop may still happen. These variables are only suggestive and provide no assurances.

If the market acts differently than you had anticipated, it is essential to close out your position to avoid catastrophic losses and failures. When trading intraday, more leverage is available, which effectively produces decent profits in a single day.

Develop Your Strategy

Regardless of the market you trade, use a demo account to evaluate your trading strategy. This makes it possible for you to continue honing your skills even after the market has closed. Since no two trading days are ever the same, it takes talent to be able to spot trade setups and go on with transactions without hesitation.

Most traders experience a decline in performance when they transition from demo trading to live to trade. You can test your strategy using demo trading to see if it is effective. It cannot replicate the real market.

As a result, if you find that your trade isn't doing as well on life as it did on the demo, realize that this is normal. You'll ultimately notice an improvement in your performance if you stick to your plan and don't trade emotionally.

Ignore Penny Stocks

Without a doubt, you're looking for deals and low prices but stay away from penny stocks. Since these stocks are frequently illiquid, your chances of becoming wealthy with them are frequently low.

Many equities that trade for less than $5 per share are taken off the main stock exchange lists and may only be traded over the counter. Unless there is a real likelihood and you have done your research, stay away from them.

Control Your Emotions

When trading is worthwhile, learn to regulate your emotions. Maintain focus on your predetermined goals and resist being swept away by the stock's upward trend in signals.

Conclusion

Even while intraday trading is riskier than normal trading, when done correctly, it may be one of the most rewarding tactics. Having said that, having a trading and demat account, your plan and a ton of patience are definitely necessary to engage in day trading.