Are you looking for a way to easily manage your investments on the go? If so, you're in luck! Several great tech solutions can help make this process much easier. In this blog post, we will discuss four of the best options currently available.

Investment Tracking Apps

Investment tracking apps are a great way to keep an eye on your investments and make sure they're doing well. Most of these apps allow you to view your portfolio, monitor your current holdings, and get real-time updates on the market. Some different investment tracking apps on the market can help you keep track of your investments and portfolio performance. There is also the best stock ticker app which gives you streaming quotes for stocks, indexes, futures, and Forex. These apps can provide you with real-time updates, as well as historical information on your investments. Some of the most popular investment tracking apps include Mint, Personal Capital, Bloomberg, and Morningstar Investment Research Center.

Mint is a free app that provides users with a comprehensive view of their financial situation, including all of their investment and banking information. Personal Capital is also a free app, and it offers users insights into their overall portfolio performance, as well as specific details on individual investments. Bloomberg is a paid app that provides in-depth analysis of global markets and securities, while Morningstar Investment Research Center is a paid app that offers extensive information on stocks, mutual funds, and exchange-traded funds (ETFs). If you are looking for an investment tracking app to help you stay informed about your portfolio’s performance, any of the apps mentioned above would be a good option. Just be sure to read the reviews before choosing one, so you can find an app that best suits your needs.

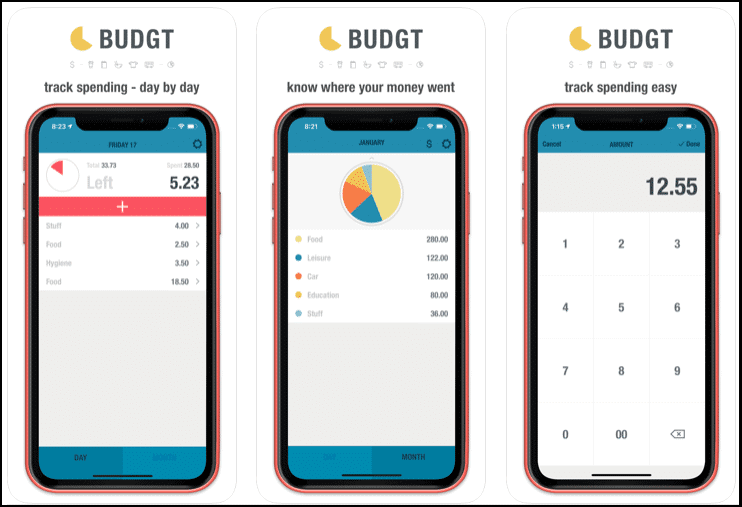

Financial Planing Apps

If you're looking for a more efficient way to manage your investments on the go, many great financial planning apps can help. You Need A Budget (YNAB) is designed specifically for those who want to get their budgets under control. The app helps you break down your spending into categories so that you can better understand where your money is going. If you're looking for an app that focuses on long-term investing, then Wealthfront may be the right choice for you. It offers portfolio management, tax optimization, and even goal-setting features. No matter which app you choose, using one of these solutions can help make managing your investments on the go much easier.

Robo-Advisors

If you're looking for a more hands-off approach to managing your investments, Robo-advisors can be a great option. These platforms use algorithms to automatically invest your money in a diversified portfolio, based on your risk tolerance and investment goals. And since they work online, you can access them from anywhere with an internet connection.

Most Robo-advisors charge very low fees, making them a cost-effective option for those who want to minimize expenses. However, it's important to do your research before choosing one, as not all of them are created equal. Be sure to compare features like account minimums, management fees, and the types of investments offered. You can find a list of reputable Robo-advisors on sites like NerdWallet and Forbes. And if you're not sure which one is right for you, they often offer free trials so you can test them out before signing up. So if you're looking for an easy way to manage your investments on the go, consider using a Robo-advisor. They'll do all the hard work for you.

Online Portfolios

If you're like most people, you probably don't have the time to sit down and review your investments regularly. That's why online portfolios are such a valuable tool – they allow you to manage your investments from anywhere, at any time. By using an online portfolio service, you can keep track of your stocks, bonds, and other investments with just a few clicks. Plus, many of these services offer real-time updates so you can stay on top of your portfolio performance no matter where you are.

So if you're looking for a way to easily manage your investments on the go, be sure to check out some of the best online portfolio services available today. And remember, it's always important to consult with a financial advisor to make sure you're making the best choices for your unique situation. Some of the top online portfolio services include Morningstar Portfolios, Fidelity Go, and Betterment. Morningstar Portfolios is a well-known name in the investment world, and its online portfolio service offers a wide range of features and tools. Fidelity Go is another great option for those looking for a low-cost portfolio management solution, and Betterment is perfect for investors who want to take a hands-off approach to invest.

The four solutions that we have looked at are all great options for managing your investments on the go. They are all user-friendly and easy to use, so you can get the most out of your portfolio without having to worry about complicated processes or procedures. So, if you are looking for a way to make investing easier and more convenient, be sure to check out these four solutions.