With crypto trading quickly becoming a norm in the business and finance industries, it is more pertinent than ever to know the ins and outs of crypto trading.

One of the biggest things to keep in mind are the differences between manual trading and bot trading methods. Keep reading for some things to consider before choosing your preferred crypto trading method.

Let's Cover the Basics

The basics are the foundation for all other decisions, so it is wise to know them. The most fundamental difference between manual trading and bot trading is that manual trading involves you personally making the trade decisions, while bot trading involves a robot making trade decisions based on certain parameters.

If you are inexperienced in crypto trading and you do not want to learn how to do it properly, bot trading will probably be your best bet. However, if you are good at it or are willing to learn and you want to be able to make changes to your trading habits at a moment's notice, you will probably like manual trading better.

Following the Rules

There are many rules to crypto trading, include some that you have for yourself and yourself alone. However, humans have a tendency to break rules when things get very tempting or difficult, so manual trading will have that same element as humans are running the trading process.

However, when a robot goes to an OKX trade spot they are focused only on what is programmed into them, nothing more and nothing less. They will not be tempted to buy something that is not needed. Instead, they will perform their function and get the job done. Such a focused approach is good for trading.

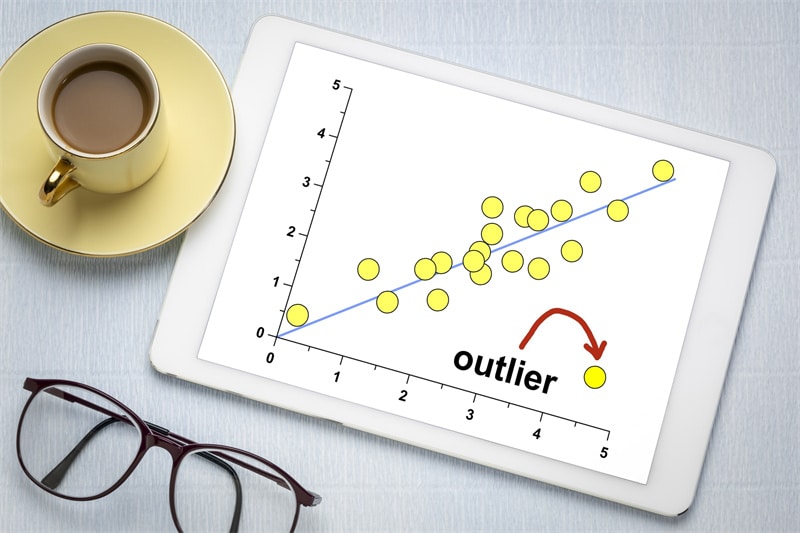

Outlier Awareness

Crypto trading is not always so straightforward. One event or even one word can change the result of a transaction for better or worse. Because of their focus, bots cannot take any outliers or unexpected occurrences into consideration unless they are programmed to.

Meanwhile, humans can look at any and all factors and statistics and make split-second decisions if need be. For instance, if a natural disaster or stock market crash were to affect the U.S., you would see a significant shift in the values and trends of crypto in trade spots across the country. In instances like this, your choice of crypto trading could mean the difference between coming out on top or losing everything you have.

The world of crypto trading is vast and is getting bigger all the time. Once you are ready, head to your preferred crypto trading platform and take the steps to get started. Keep this article in mind as you choose a crypto trading method that works best for you.

Some platforms allow you to do both depending on what you prefer, and if you get tired of one method, you can always switch if you feel like trying the other method on for size. No matter what, stay safe while trading and always keep a record of your activity.