Are you bored with the Insufficient liquidity error? Read on to learn about its meaning and how to fix it.

The cryptocurrency market is a highly volatile one, and it doesn’t take much for the value of your assets to change significantly. In fact, the value of Bitcoin fluctuates by an average of 2.67% each day. While this can be frustrating for those who trade in cryptocurrencies, the volatility also presents some interesting opportunities for traders to make money.

Unfortunately, this kind of trading isn’t as easy as it sounds because it requires having access to multiple exchanges and being able to move assets quickly from one exchange to another within minutes or seconds. This means that there must be sufficient liquidity for each asset being traded on each exchange – but only if you want to trade quickly enough to make money from such kinds of trades!

Disaster strikes when you receive the Insufficient Liquidity error. So, your next move in such instances determines whether you'll get a profit or not. Read on as we guide you on how to manage and fix this error.

What Does “Insufficient Liquidity for This Trade” Mean?

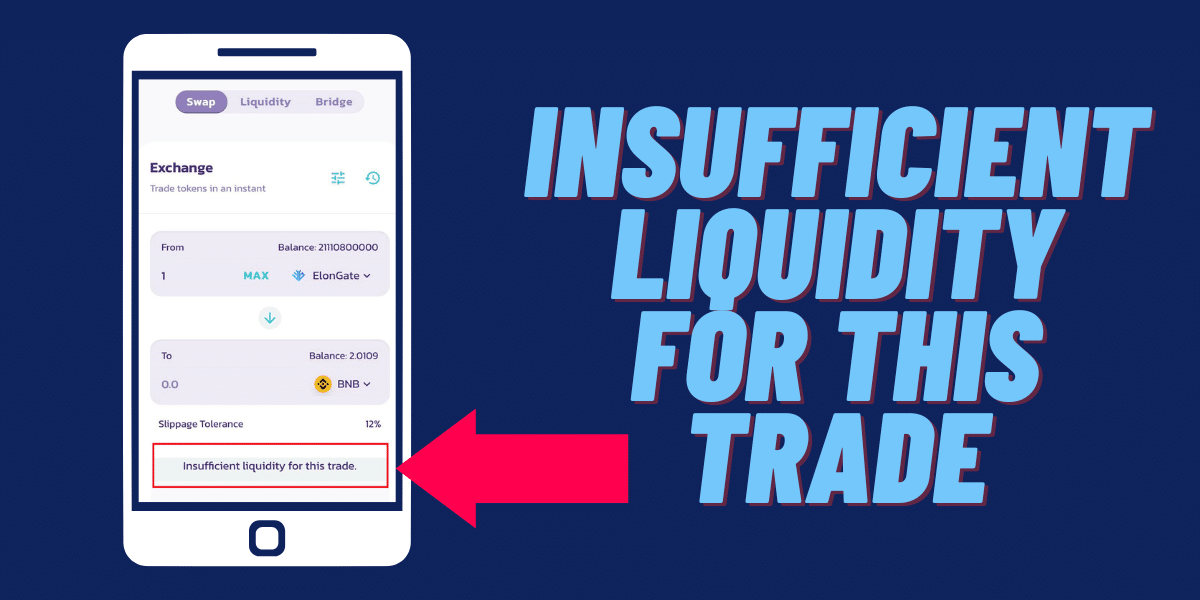

“Insufficient Liquidity for This Trade” is a common error message that crypto traders see when they try to execute a trade. The message can also appear in other situations, such as when you’re trying to swap tokens or withdraw funds from your exchange account.

When this message appears, it means that there isn’t enough token or currency available on the market to complete your trade at the current price.

You may need to know that liquidity refers to the token amount or currency that can be traded in the cryptocurrency market. What happens is liquidity providers can either join liquidity pools by paying with their funds as a way to decentralize the exchange platform. So, in return, the liquidity provider earns from transaction fees when other traders use the liquidity pool.

It, therefore, is up to the exchange platform, such as Pancake Swap, to determine the specific amount that liquidity providers should deposit. In this case, when the insufficient error message is displayed, it means the current liquidity pool doesn’t have sufficient tokens or assets enough for the specific trade.

Why Does PancakeSwap Say “Insufficient Liquidity for This Trade”?

PancakeSwap is an automated trading system that uses a combination of technical analysis, fundamental analysis, and machine learning to predict the market's movement. It is designed to work with any cryptocurrency pair and any time frame.

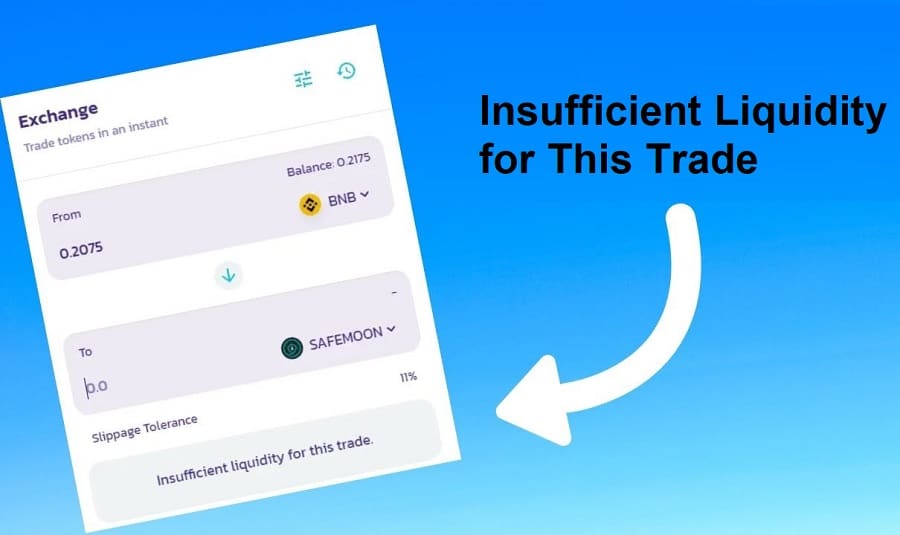

However, before trading, the creator develops a liquidity pool with a specific amount of paired cryptocurrencies. However, when trading and you receive the [Insufficient Liquidity for This Trade], it means the liquidity pool has not had enough tokens for the trade.

This also happens when you are using the latest version of the exchange. PancakeSWap switched from VI to V2 in mid-2021, so you must know that with the latest version (V2), you may often receive the [Insufficient Liquidity For this Trade] whenever you want to swap for a token. This, therefore, means you can't swap older tokens. Sometimes, the error message can result from too low or very high slippage tolerance.

How to Manage “Insufficient Liquidity for This Trade”?

Insufficient liquidity is a term used by cryptocurrency exchanges to describe the sudden inability of traders to sell or buy large amounts of cryptocurrency. The reason for this, as said before, varies, but the main one could be the lack of enough tokens to complete the trade. There are, however, many other reasons, and here is how to fix them.

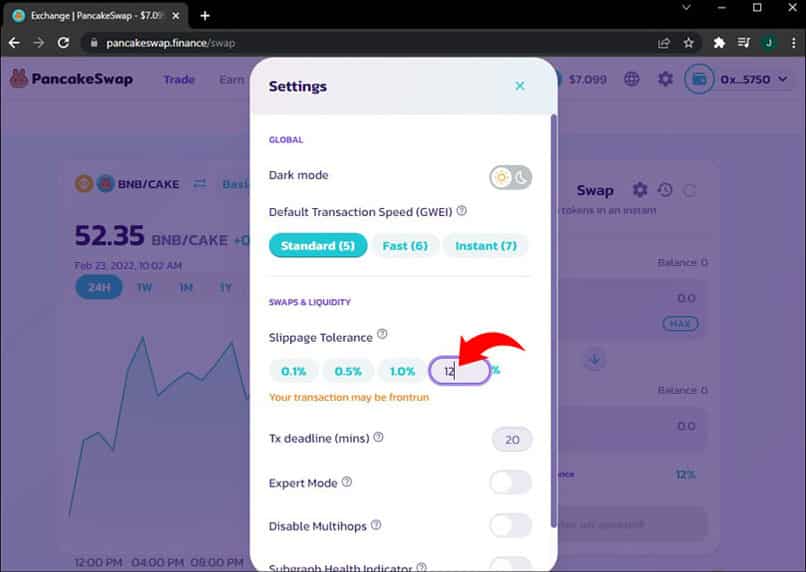

Raise Your Slippage Tolerance

Slippage is the difference between the expected price of a trade and its actual execution price. In other words, slippage is the result of an order not being filled at the price you specified. So, raising your slippage tolerance will increase how much you are willing to lose per trade.

A higher slippage tolerance increases your potential profits but also increases your risk. So, your order won't be filled when your slippage tolerance is lesser than the executed price difference. This will also be the same when you have extra high slippage tolerances unless you adjust the slippage accordingly.

Switch Your Network

If you're using an Internet connection provided by a company, it's possible that the network is blocking your cryptocurrency exchange. If you can switch to a different Internet connection (for example, from your mobile data plan), try accessing your exchange again.

If you're using Wi-Fi from a cafe or restaurant, ask if they have a firewall that might block your access to the exchange. If so, ask if they can disable their firewall for a few minutes so that you can log in and trade. Alternatively, you can switch from the WIFI completely to your data connection.

Confirm the Status of the Decentralized Exchange Server

Sometimes decentralized crypto exchanges experience periods of downtime due to technical issues or maintenance work being performed on them. You may be able to find out whether this is happening by looking at some third-party websites for updates on their status.

You can check on PancakeSwap Server and UniSwap Server. If they're down for maintenance, this will generally last only briefly while they fix whatever problem has arisen.

Try a Different Exchange

The good news is that there are many exchanges out there, and it’s likely that one of these will have enough liquidity for your trade.

The easiest way to find a different exchange is to use the coinmarketcap website. Just enter the trading pair you want to buy into their search box, and you will be shown all exchanges that currently have this trading pair available for trading.

Then simply go through each exchange, one by one, until you find one where the order book has sufficient liquidity for your trade size. It is not compulsory that you use UniSwapp or PancakeSwap; you can also use HoneySwap, TraderJoe, SushiSwap, Bogged Finance, and DODO exchange, among many others.

Be Patient

This might sound like an obvious one, but it’s worth mentioning anyway. The problem will eventually resolve itself if you wait long enough. The issue could be that there is not enough liquidity for this trade or that the exchange is having temporary technical issues at the moment (this happens sometimes).

However, if none of these methods works out, it could mean there's no problem on your end. It could be something to do with the tokens you are attempting to swap. In this case, the best thing you can do is join the PancakeSwap Telegram group for further help.

Conclusion

Cryptocurrency trading is becoming really popular these days, and it offers you a set of new opportunities. However, there are also some risks that are associated with it. For instance, the lack of liquidity can influence the price. This should, however, not discourage you in any way, the best thing to do is handle it correctly, and you can be sure to attain your expected profits or something close to what you expected.