Blockchain technology and digital coins are relatively new, having been plagued for many years by old-fashioned scams, including pump and dump schemes. Did you know that pump and dump schemes are considered completely illegal on regulated crypto exchanges?

Just as the Wild West of securities is growing, cryptocurrency trading is also constantly growing and changing. If we talk about the cryptocurrency market, it is essentially a new and rapidly expanding frontier for the people. With celebrity endorsements and a cult-like following, this property is becoming quite the thing to invest in.

There are a few schemes associated with the unregulated crypto sector that have been provided on a fairly rich basis, to ensure users do not get caught by the authorities in a fairly easy way. Some of the main questions associated with the blockchain niche are: “What are pump and dump schemes?”

All the process is laid out and all the plans are looked at carefully to run this post. And if you like to engage in trading these cryptocurrencies then you should visit https://ekrona-app.com

What are Pump and Dump Schemes?

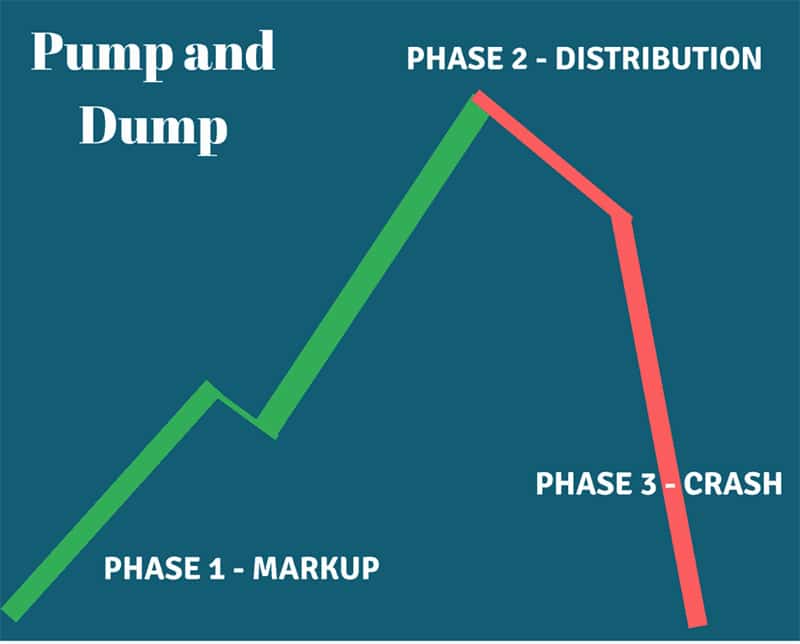

Cryptocurrency pump-and-dump is represented by a scheme where an individual or group of individuals is required to create a scheme to profit by pumping their assets into their market. “Pumping” is a term used to inflate the price and demand for the coins concerned, as well as to indicate the purchase of all coins in a larger quantity.

The asset has to be issued at a higher price to achieve higher returns by investing. To take maximum advantage of the demand and supply market dynamics, scammers can view the huge price volatility as a trend. There are also cases where scammers think to target new and unpopular coins because they will not need much money to perform the manipulation.

Coin offerings are targeted with scammers to gain more profit through pump and dump schemes, as many investors are psychologically fully prepared to make the purchase. Intensive lobbying is first carried out by ICOs, with one main goal being to expose the pumped assets in the light.

How to Dump and Pump Works

Pump and Dump is a scheme which has a team of techno-competent, organized players and motivated at the centre. It does its job to make the promotion look real and with different points to all their players.

The team is composed of a handful of investors who help provide funds to buy the tokens and drive demand for them. The selected tokens are low-volume assets, allowing scammers to control and control the price by buying most of them.

How to Find a Pump and Dump Scam in Crypto?

The most important question in this whole blog is how to spot a Pump and Dump scam inside our trading network? The simple thing which can be done is:

- Using an entrusted digital exchange

The most important thing in this entire scam is to follow the trusted exchange which has strict rules and guidelines for such fake trading news and doesn't allow such corrupt practices inside their platforms.

- Doing complete research about the trading asset

The foremost step before investing in a scam is to have a background check of the trading asset, you must check about its origin, white paper and what are its serving objectives, also go through its long-term policies about any potential growth.

The Bottom line

Pump and Dump schemes work on the newly minted coins and unregulated supply and demand of the market, they trap the people in their game of pumping the prices of the coin and suddenly crashing the prices but as the user realises the scam, it’s been too late.