There aren’t a lot of things in this world that are permanent but one of those that will always matter is taxes. Whether you’re a business owner or an employee for a company, taxes are going to be an important part of your annual routine. It’s your responsibility as a law-abiding citizen and it’s something that you should never forget doing.

Understandably, doing taxes can be a bit taxing. There are dozens of forms to worry about and there are a lot of things that you need to be mindful of as well. One of the tax forms that you can file is 1099-NEC and surprisingly, not a lot of people fully comprehend how crucial this form is. Here’s a closer look at it.

What Is Form 1099-NEC?

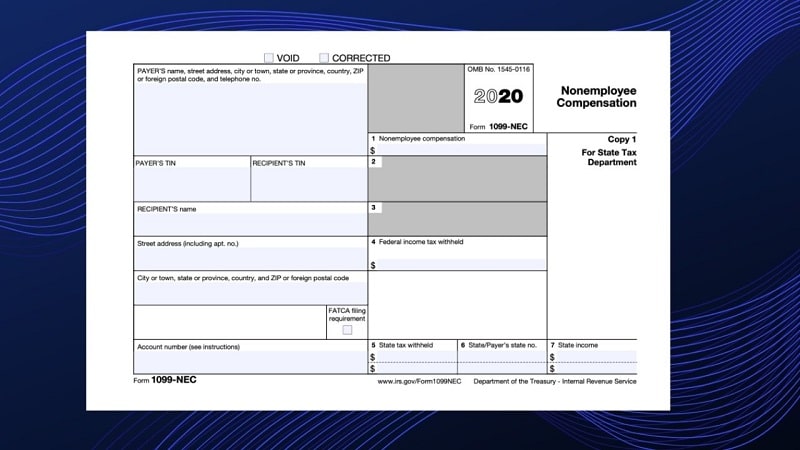

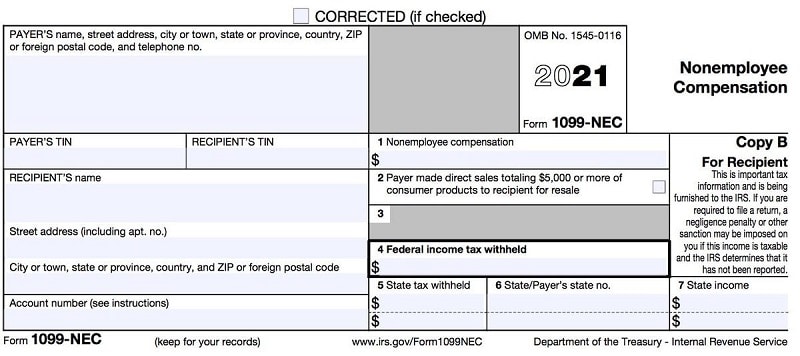

Before we look at the process behind filing Form 1099-NEC, it is important that you understand what it is first. To begin with, Form 1099-NEC isn’t a new form. In fact, it has been around since 1982. The IRS brought it back just recently to help support those who are classified as being self-employed.

Traditionally, you’ll pay taxes through non-employee service providers on line 7 of Form 1099-MISC. Now, you’ll have to do so through Form 1099-NEC. It’s a big jump to what most self-employed individuals have been used to which is why not a lot of people understand the differences at first.

To put it simply, Form 1099-NEC is different because it directly tackles work income and reimbursed expenses. It really is tailor-made for self-employed individuals. As it is new, some people use the Form 1099 Excel template instead. It’s fast, easy, and it lessens the risk of making mistakes.

Types Of Deductions

When filing your taxes through Form 1099-NEC, you’ll have to be considerate of some deductions. Keep in mind that this form is not your typical tax form so that means you’ll have to be mindful of the differences in terms of deduction as well. So, what types of deductions are there?

Let’s look at it from the perspective of a business owner. Basically, any expense that you incur is a part of your taxes – no matter how small. This can include meals, supplies, and even gas fees. That being said, you face more possible deductions when filing your taxes using this form.

As such, it’s very important that you meticulously keep track of your expenses as a self-employed individual. We suggest making a daily list of all of your expenses and income through a tracking sheet. This way, you don’t have to rush or scour your documents for the expenses later on.

Another tip to consider is that you should try to get help from someone who has already filed this form before. Since these are taxes we are talking about, there should be no margin of error as you could end up paying more than what you owe. In most cases, you could also end up paying less than what you owe which is a bigger problem.

The good news is that so long as you keep track of your expenses and that you use a template, filing a Form-1099 NEC will come by very easily.

Considerations When Filing Form-1099 NEC

In truth, the filing of Form-1099 NEC remains very similar to other tax forms. The only difference is the deductions you have to make. The rest of the process flows similarly to how you would file your taxes through other forms as well. That being said, you should still be mindful of a few considerations when filing a Form 1099 NEC.

The IRS gives four conditions which will be considered as a non-employee payment:

- You made a payment to someone who is not your employee or is your worker.

- You made a payment for services that are related to your craft or business.

- You made a payment to a private individual, estate, corporation, or another business entity.

- You made a payment to the payee worth at least $600 during a year.

With these considerations in mind, you can see that Form-1099 NEC can be quite complex. However, once you get a full understanding of the difference between it and other tax forms, you’ll find that it’s actually very easy to accomplish this form just like any other.

Filing your taxes manually will always be a lot of work. However, knowing the differences between the various tax forms out there can make a difference and can make your life easier as well. With these considerations and learning in mind, you’ll be able to file your Form-1099 NEC without any worries easily.