As a new stock trader, trading can seem like an intimidating challenge. There’s a lot to learn, and you probably want to have all the information possible so that you can make only the most profitable decisions.

It is, of course, not possible to win every trade. However, if you keep a few crucial considerations in mind before you start trading, you’ll soon find that you’re winning more trades than you’re losing – which will, of course, mean that you’re making money.

If you’re wondering what these considerations are, keep reading.

1. Be Careful of Fees and Commissions

Consider this situation: you buy a stock for $2, and you sell it for $3. This means that you made a profit on the sale, correct? Well, not necessarily.

One part of trading that many people often forget about is the fees and commissions. Fees and commissions are the portions of your profit that you have to pay to brokerage for the facilitation of your trade. Depending on the fee structure of the brokerage you choose, these can add up quickly.

Before you choose a brokerage service, make sure you thoroughly understand what fees and commissions they require. This will prevent you from facing a situation in which you sell a stock for more than you bought it, but will still lose money on the trade.

2. Keep the Data in Mind

Remember, trading doesn’t always need to be a gamble. Instead, as the team on the ThinkorSwim platform points out, data should help guide your trading decisions. Having the right data on hand significantly reduces the risk of losing money on a trade.

Make sure to thoroughly research every trade you make (or are considering making). This is especially important with higher value trades, or trades in which you’re using a good amount of your trading budget.

However, this can be a time-consuming task. That’s where a robo-advisory comes in. These advisors are data-driven and will be able to provide you with advice using millions of data points. That said, as with brokerages, make sure to research the robo-advisory you choose thoroughly, in order to be confident about choosing the right option.

3. Take Careful Risks

Risks are an essential part of success – these are the trades that often work out the best. At the same time, however, you don’t want to risk all your money on a single trade.

When it comes to taking trading risks, it’s essential that you balance the risk and the potential rewards carefully. Take several data points – like averages, volatility, and others – into consideration. Only when you’ve weighed all the pros and cons should you make a decision.

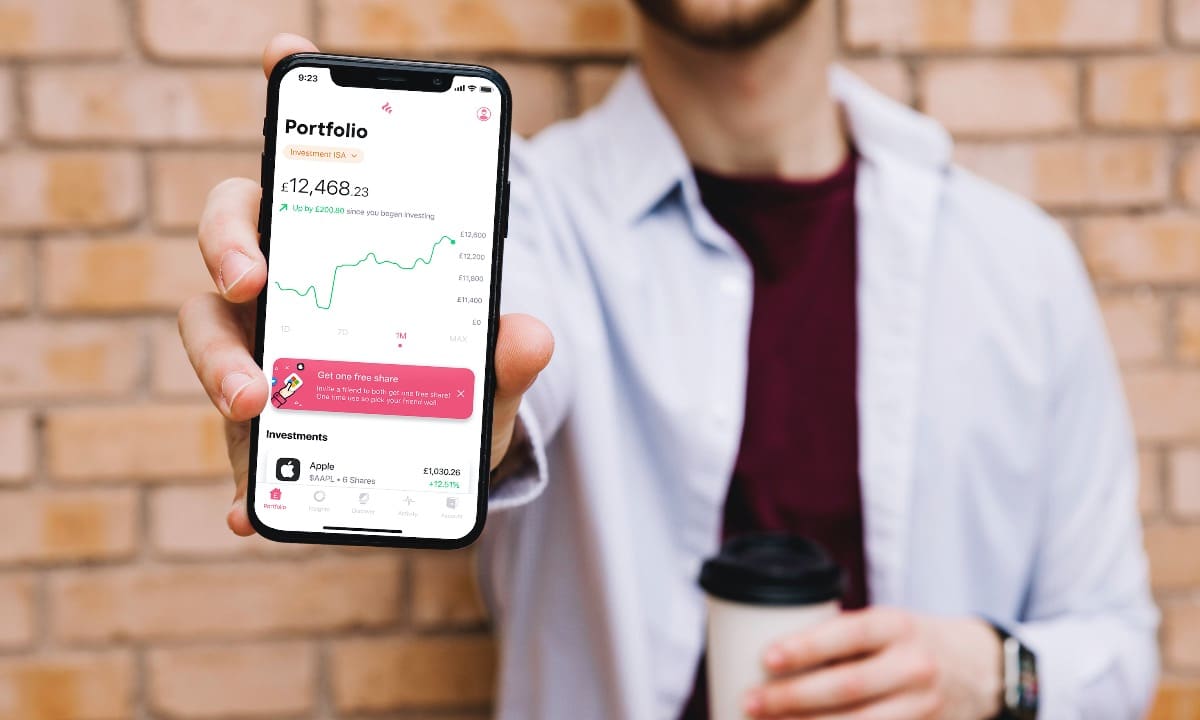

4. Consider the Platform

As discussed above, the brokerage platform you choose will play a key part in determining how successful you are as a trader. However, this does not only refer to the fees and commissions the platform charges.

Make sure to take the platform’s ease of use into account as well. If the platform is too complicated for you to use, there’s a lower chance that you’ll make the jump into trading. An easy-to-use platform, on the other hand, is inviting and makes you want to start trading as soon as possible.

5. Think About Customer Service

This, again, is another factor to keep in mind when choosing a brokerage platform as a trader. Even the best traders occasionally face issues – and that’s where good customer service comes in.

If the customer service on your platform is good, your issues will be resolved quickly. Bad customer service, on the other hand, can result in days of waiting and may lead to you losing out on extremely profitable trades. A platform’s customer service isn’t just a matter of convenience, it’s also a matter of money.

6. Use a Stop Loss

One of the most challenging parts of trading is knowing when to cut your losses. Many people hold on to stocks that are clearly on a steep downturn in the hopes that they will recover. However, this only compounds the loss.

In order to avoid this from happening to you, consider using a stop loss. This is essentially a limit that you will apply to your stocks – if they fall below a certain, pre-set threshold that you decide on, the brokerage platform will automatically liquidate those shares in order to limit your losses. This will help you stay disciplined and can often lead to people becoming better at recognizing when it’s time to sell.

Ultimately, it’s essential to remember that trading is a complex proposition. There will be a learning curve, and you will take some time to get your legs underneath you. However, by speaking to people with experience in the field and researching the strategies that experienced and successful traders use, you’ll also soon learn just how profitable trading can be, when done right. That said, don’t forget the key principle of any good trader – always be prepared to make investments for the long term!